Appearance

盈透证券: 1042-S表格

1042-S表格是美国国税局(IRS)用于报告非美国居民(Nonresident Aliens)在美国获得的某些类型收入的税务文件,特别是与股息、利息、特许权使用费等相关的收入。

在盈透证券(Interactive Brokers, IBKR)账户中,中国居民(非美国税务居民)通常会收到1042-S表格,主要用于报告美股股息、部分利息收入等,并涉及中美税收协定下的预扣税(通常10%)。

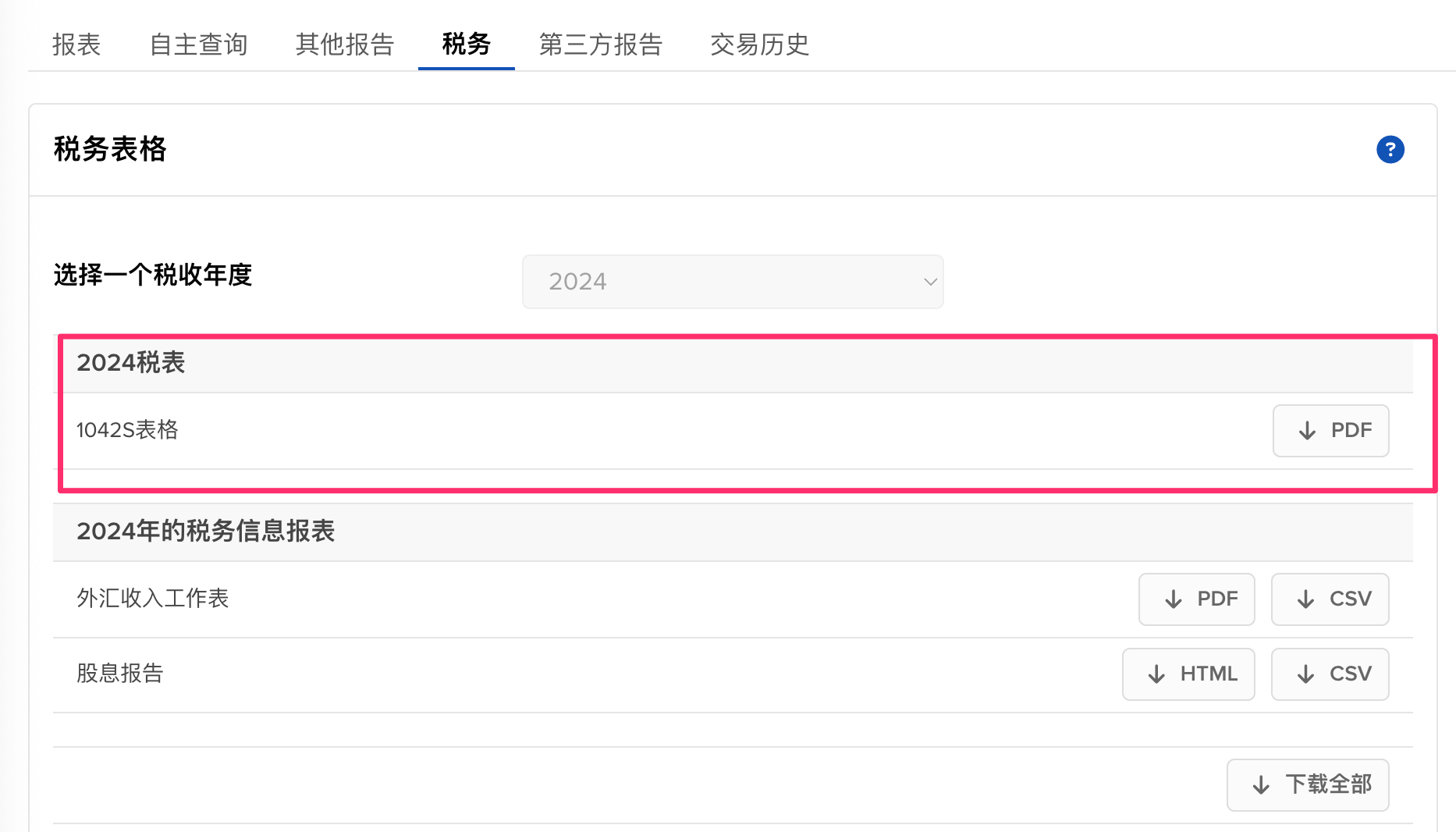

如何在IBKR查看1042-S表格?

IBKR会在每年3月15日前生成1042-S表格(IRS要求),并通过Client Portal提供电子版。

1、打开链接 https://www.ibkr.com.cn/sso/Login, 登录盈透后台。

2、在顶部菜单选择 「Reports(业绩与报告)」 > 「Tax Documents(税务文件)」。

3、点击「1042S表格」右侧的「PDF」按钮,可下载或查看「1042-S」表格。

怎么理解1042-S表格

1042-S表格包含多个字段:

- Box 1 - Income Code:收入类型代码。

- 01:利息(Interest,如IBKR现金余额利息)。

- 06:股息(Dividends,最常见,如美股分红)。

- Box 2 - Gross Income:总收入金额(美元),如股息或利息总额。

- Box 3 - Exemption code和Exemption Code:使用的税率。

- 填写W-8BEN的话,利息税率为0%,股息税率为10%。

- Box 7a - Federal Tax Withheld:预扣税金额。

- Box 10 - Total Withholding Credit:可抵扣的预扣税总额。

- Box 13 - Recipient Information:你的个人信息: 姓名、国家、地址、税号(中国身份证)、账号、生日等。

每类收入类型的表格,都有四份,分别是:Copy A、Copy B、Copy C、Copy D。

- Copy A : 扣缴代理人(通常是支付美国来源收入的机构)提交给美国国税局(IRS)的副本。

- Copy B : 账户持有人提交给居住国税务机关(如中国税务局)申报境外所得/抵免。

- Copy C : 账户持有人个人记录,核对收入/预扣税。

- Copy D : 提交美国州税务机关,中国用户不适用。

1042-S表格代码定义

Income Code

Interest

| Code | Types of Income |

|---|---|

| 01 | Interest paid by U.S. obligors—general |

| 02 | Interest paid on real property mortgages |

| 03 | Interest paid to controlling foreign corporations |

| 04 | Interest paid by foreign corporations |

| 05 | Interest on tax-free covenant bonds |

| 22 | Interest paid on deposit with a foreign branch of a domestic corporation or partnership |

| 29 | Deposit interest |

| 30 | Original issue discount (OID) |

| 31 | Short-term OID |

| 33 | Substitute payment—interest |

| 51 | Interest paid on certain actively traded or publicly offered securities |

| 54 | Substitute payments—interest from certain actively traded or publicly offered securities |

Dividend

| Code | Types of Income |

|---|---|

| 06 | Dividends paid by U.S. corporations—general |

| 07 | Dividends qualifying for direct dividend rate |

| 08 | Dividends paid by foreign corporations Dividend |

| 34 | Substitute payment—dividends |

| 40 | Other dividend equivalents under IRC section 871(m) |

| 52 | Dividends paid on certain actively traded or publicly offered securities |

| 53 | Substitute payments—dividends from certain actively traded or publicly offered securities |

| 56 | Dividend equivalents under IRC section 871(m) as a result of applying the combined transaction rules |

Other

| Code | Types of Income |

|---|---|

| 09 | Capital gains |

| 10 | Industrial royalties |

| 11 | Motion picture or television copyright royalties |

| 12 | Other royalties (for example, copyright, software, broadcasting, endorsement payments) |

| 13 | Royalties paid on certain publicly offered securities |

| 14 | Real property income and natural resources royalties |

| 15 | Pensions, annuities, alimony, and/or insurance premiums |

| 16 | Scholarship or fellowship grants |

| 17 | Compensation for independent personal services |

| 18 | Compensation for dependent personal services |

| 19 | Compensation for teaching |

| 20 | Compensation during studying and training |

| 23 | Other income |

| 24 | Qualified investment entity (QIE) distributions of capital gains |

| 25 | Trust distributions subject to IRC section 1445 |

| 26 | Unsevered growing crops and timber distributions by a trust subject to IRC section 1445 |

| 27 | Publicly traded partnership distributions subject to IRC section 1446(a) |

| 28 | Gambling winnings3 |

| 32 | Notional principal contract income |

| 35 | Substitute payment—other |

| 36 | Capital gains distributions |

| 37 | Return of capital |

| 38 | Eligible deferred compensation items subject to IRC section 877A(d)(1) |

| 39 | Distributions from a nongrantor trust subject to IRC section 877A(f)(1) |

| 41 | Guarantee of indebtedness |

| 42 | Earnings as an artist or athlete—no central withholding agreement |

| 43 | Earnings as an artist or athlete—central withholding agreement |

| 44 | Specified federal procurement payments |

| 50 | Income previously reported under escrow procedure |

| 55 | Taxable death benefits on life insurance contracts |

| 57 | Amount realized under IRC section 1446(f) |

| 58 | Publicly traded partnership distributions—undetermined |

| 59 | Consent fees |

| 60 | Loan syndication fees |

| 61 | Settlement payments |

Exemption Code

Chapter 3

| Code | Types of Income |

|---|---|

| 01 | Effectively connected income |

| 02 | Exempt or reduced withholding under IRC7 |

| 03 | Income is not from U.S. sources |

| 04 | Exempt or reduced withholding under tax treaty |

| 05 | Portfolio interest exempt under IRC |

| 06 | QI that assumes primary withholding responsibility |

| 07 | Withholding foreign partnership or withholding foreign trust |

| 08 | U.S. branch treated as U.S. person |

Chapter 5

| Code | Types of Income |

|---|---|

| 13 | Grandfathered payment |

| 14 | Effectively connected income |

| 15 | Payee not subject to chapter 4 withholding |

| 16 | Excluded nonfinancial payment |

| 17 | Foreign entity that assumes primary withholding responsibility |

| 18 | U.S. payees of participating FFI or registered deemedcompliant FFI |

| 19 | Exempt from withholding under IGA8 |

| 20 | Dormant account |

| 21 | Other payment not subject to chapter 4 withholding |

官方文件

联系小丸子

加微信后留言「境外」,可加入「境外投资讨论群」;留言「分红」,可加入"了解香港保险的群"(保险群暂时不对保险从业人员开放,见谅~)

还建一个付费知识星球,用来同步家庭四账户的实盘操作、分享投资知识、与同频的小伙伴深度交流投资,目前正在试运营,有兴趣可扫码加入。