Appearance

英伟达发给华尔街卖方分析师的Memo全文

Source documents

- Michael Burry on Twitter / X

- The Algorithm That Detected a $610 Billion Fraud: How Machine Intelligence Exposed the AI Industry’s Circular Financing Scheme

Share repurchases have not created shareholder value

Claim:

Since the beginning of 2018, NVDA earned about $205B net income and $188B free cash flow, assuming all Capex was growth Capex. SBC amounted to $20.5B. But it bought back $112.5B worth of stock and there are 47 million MORE shares outstanding. The true cost of that SBC dilution was $112.5B, reducing owner’s earnings by 50%.

Response: NVIDIA repurchased $91B shares since 2018, not $112.5B. Mr. Burry appears to have incorrectly included RSU taxes. Employee equity grants should not be conflated with the performance of the repurchase program. NVIDIA’s employee compensation is consistent with that of peers. Employees benefitting from a rising share price does not indicate the original equity grants were excessive at the time of issuance.

With respect to the repurchase program, the correct question is the price repurchased compared to intrinsic value. At an average price of $51, NVIDIA’s repurchases since 2018 were made well below intrinsic value and therefore created substantial value for shareholders, boosting EPS by 5% and creating $200B+ of market capitalization at constant P/E.

Accounts receivable growth indicates customers are not paying

Claim:

NVIDIA’s Days Sales Outstanding (DSO) of 53 days is higher than the historical average of 46 days from FY20 to FY24, indicating NVIDIA is not collecting from customers.

Response:

NVIDIA’s average DSO from FY20 to FY24 was 52 days, not 46 days. In this context, NVIDIA’s Q3 DSO of 53 days was consistent with the long-term average. NVIDIA’s DSO actually decreased sequentially from 54 days to 53 days. Additionally, NVIDIA is not struggling to collect from customers; overdue A/R is negligible.

Inventory growth indicates waning demand

Claim:

Growing inventory in Q3 (+32% QoQ) suggests that demand is weak and chips are accumulating unsold, or customers are accepting delivery without payment capability, causing inventory to convert to receivables rather than cash.

Response:

First, growing inventory does not necessarily indicate weak demand. In addition to finished goods, inventory includes significant raw materials and work-in-progress. Companies with sophisticated supply chains typically build inventory in advance of new product launches to avoid stockouts. NVIDIA’s current supply levels are consistent with historical trends and anticipate strong future growth.

Second, growing inventory does not indicate customers are accepting delivery without payment capability. NVIDIA recognizes revenue upon shipping a product and deeming collectability probable. The shipment reduces inventory, which is not related to customer payments. Customers are subject to strict credit evaluation to ensure collectability. Payment is due shortly after product delivery; some customers prepay. NVIDIA’s DSO actually decreased sequentially from 54 days to 53 days.

Third, NVIDIA signaled that Q4 revenue guidance expects an increase of $8B sequentially to $65B. With longer cycle times for sophisticated solutions, the increase in inventory should be expected; otherwise the revenue guidance would not be feasible.

Cash flow conversion indicates low quality of earnings

Claim:

NVIDIA generated $14.5B in cash from operations during Q3 fiscal 2026 while reporting net income of $19.3B. The resulting 75% cash conversion ratio falls well below semiconductor peers including TSMC, AMD, and Intel.

Response:

First, in Q3, NVIDIA generated $23.8B of cash from operating activities and $22.1B of free cash flow, not $14.5B. NVIDIA reported net income of $31.9B, not $19.3B.

Second, NVIDIA’s free cash flow conversion is healthy and consistent with historical trends. A company with growing revenue normally invests in working capital and fixed assets, reducing free cash flow relative to net income in the short term; in the long term, free cash flow should approximate 100% of net income. Since FY18, NVIDIA’s free cash flow has averaged 98% of GAAP net income.

Third, NVIDIA’s free cash flow conversion is competitive with peers in the semiconductor industry. Over the past twelve months, NVIDIA generated free cash flow of $77.2B, representing 41% of revenue and 78% of GAAP net income. Over the same period, TSMC generated free cash flow of $28.3B, representing 25% of revenue and 55% of net income; AMD generated free cash flow of $5.44B, representing 17% of revenue and 170% of net income (impacted by non-cash amortization charges); Intel burned negative free cash flow of $8.4B, representing negative 16% of revenue and negative 4,086% of net income.

Circular financing is an unsustainable business practice

Claim:

NVIDIA is participating in a $610B circular financing scheme whereby NVIDIA invests in AI startups, startups commit to cloud spending, CSPs and startups purchase NVIDIA hardware, NVIDIA recognizes revenue, but the cash never completes the circuit because the underlying economic activity – AI applications generating profit – remains insufficient.

Response:

First, NVIDIA’s strategic investments represent a small share of NVIDIA’s revenue and an even smaller share of the approximately $1T raised each year across global private capital markets. In Q3 and YTD, NVIDIA invested in private companies $3.7B and $4.7B, representing 7% and 3% of revenue, respectively. The companies in NVIDIA’s strategic investment portfolio mainly raise capital from third-party financing providers, not from NVIDIA.

Second, NVIDIA is completely transparent about strategic investments, which are reported on the balance sheet in long-term assets and marketable securities, on the income statement in other income and expense, and on the cash flow statement in cash flow from investing activities.

Third, the companies in NVIDIA’s strategic investment portfolio are growing their own revenues rapidly, indicating a path to profitability and strong underlying customer demand for AI applications. The companies in NVIDIA’s strategic investment portfolio predominantly generate revenue from third-party customers, not from NVIDIA.

AI startups lose money

Statement:

Companies like OpenAI and CoreWeave generate relatively little revenue and burn cash, suggesting a disconnect between expectations and reality. A recent MIT study found that 95% of enterprise AI implementations failed to generate positive ROI within two years of deployment.

Response:

Unlike mature enterprises, emerging companies are typically valued based on future growth expectations rather than historical earnings. AI startups have grown their revenues rapidly in recent years and continue to invest heavily for future growth, burdening cash flows in the near term. Investors may rationally assign high valuations to unprofitable AI startups if the total addressable market is perceived as sufficiently large. Many investors expect AI to dramatically reorganize nearly every sector of global GDP, which currently exceeds $100T. McKinsey estimates the global economic potential of AI at $17T to $26T annually, with half of today’s work activities automated by 2045. Given this magnitude and timeframe, it is not surprising that AI companies have high valuations despite nascent commercial traction.

Reference to historical accounting frauds

Claim:

The current situation is analogous to historical accounting frauds (Enron, WorldCom, Lucent) that featured vendor financing and SPVs.

Response:

NVIDIA does not resemble historical accounting frauds because NVIDIA’s underlying business is economically sound, our reporting is complete and transparent, and we care about our reputation for integrity.

First, unlike Enron, NVIDIA does not use Special Purpose Entities to hide debt and inflate revenue. NVIDIA has one guarantee for which the maximum exposure is disclosed in Note 9 ($860M) and mitigated by $470M escrow. The fair value of the guarantee is accrued and disclosed as having an insignificant value. NVIDIA neither controls nor provides most of the financing for the companies in which NVIDIA invests.

Second, the article claims that NVIDIA resembles WorldCom but provides no support for the analogy. WorldCom overstated earnings by capitalizing operating expenses as capital expenditures. We are not aware of any claims that NVIDIA has improperly capitalized operating expenses. Several commentators allege that customers have overstated earnings by extending GPU depreciation schedules beyond economic useful life. Rebutting this claim, some companies have increased useful life estimates to reflect the fact that GPUs remain useful and profitable for longer than originally anticipated, in many cases for six years or more. We provide additional context on the depreciation topic below.

Third, unlike Lucent, NVIDIA does not rely on vendor financing arrangements to grow revenue. In typical vendor financing arrangements, customers pay for products over years. NVIDIA’s DSO was 53 in Q3. NVIDIA discloses standard payment terms, with payment generally due shortly after delivery of products. We do not disclose any vendor financing arrangements. Customers are subject to strict credit evaluation to ensure collectability. NVIDIA would disclose any receivable longer than one year in long-term other assets. The $632M “Other” balance as of Q3 does not include extended receivables; even if it did, the amount would be immaterial to revenue.

Gross margin decline indicates diminished pricing power

Claim:

Q3 FY26 GAAP gross margin was 73.4%, down 1.2% from the prior quarter. Forensic analysis suggests three possible explanations. First, channel incentives to move inventory, effectively discounting to distributors and cloud providers. Second, warranty reserves for potential Blackwell thermal issues that multiple sources have reported. Third, bad debt reserves for ageing receivables that management has not yet disclosed at appropriate levels.

Response:

The article conflates prior quarter and prior year. Gross margin increased sequentially. The company has disclosed that Blackwell GB200 margins were below H100/200 margins on a year-over-year basis given the complexity of Blackwell.

In response to forensic analysis, we note the following:

Revenue increased sequentially in the third quarter by $10B. Channel incentives to increase revenue by $10B would have a much larger impact on gross margins. NVIDIA has disclosed in previous quarters that CSP revenue is approximately 50% of revenue, which would not require channel incentives.

NVIDIA discloses quarterly warranty reserves. Warranty cost as a percent of revenue was 1.46% for YTD FY26 compared with 0.8% for YTD FY25. The increase in warranty costs reflects the complexity of Blackwell compared with prior generations. If NVIDIA increases warranty costs due to system complexity, it is properly accounting for costs in its financial statements.

Bad debt expense is recorded in G&A costs, not costs of sales, and has no impact on gross margins. NVIDIA’s bad debt is negligible.

Depreciation expense should be higher than reported

Claim:

NVIDIA is depreciating PP&E more slowly than peers, indicating that depreciation expense is understated. If properly reported, depreciation would be higher and net income would be lower.

Response:

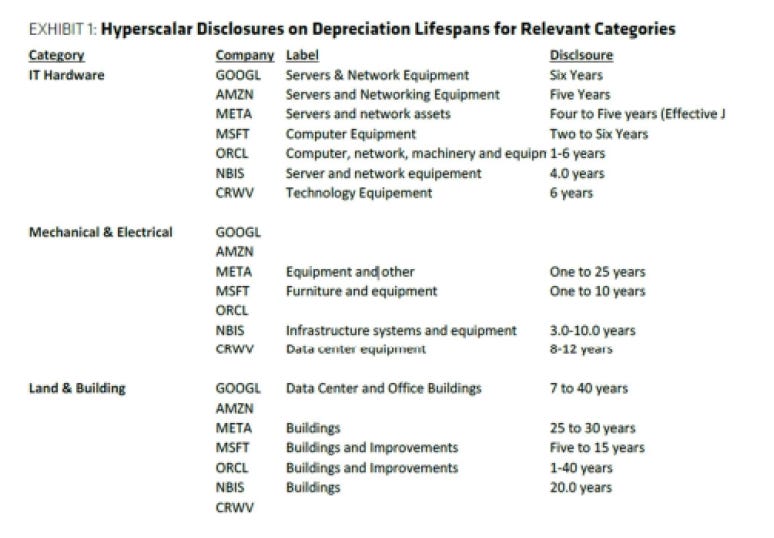

First, NVIDIA discloses useful life estimates consistent with those of peers: 2–7 years for property and equipment and 30 years for buildings. The article conflates NVIDIA’s depreciation of equipment and buildings.

Second, NVIDIA’s customers depreciate GPUs over 4–6 years based on real-world longevity and utilization patterns. Older GPUs such as A100s (released in 2020) continue to run at high utilization and generate strong contribution margins, retaining meaningful economic value well beyond the 2–3 years claimed by some commentators. See Appendix A for peer benchmarking.

Intelligent investors are selling NVDA stock

Claim:

Three significant insider transactions occurred in the two weeks preceding Nvidia’s earnings release: Peter Thiel’s Founders Fund, Masayoshi Son’s SoftBank, and Michael Burry’s Scion Asset Management.

Response:

These individuals and their funds are not insiders. We do not comment on individuals’ investment decisions.

Price of Bitcoin indicates stress in the AI sector

Claim:

Bitcoin’s price movements provide real-time tracking of AI sector stress. Bitcoin’s price decreased 29% in recent weeks, and the correlation between NVIDIA’s stock price and Bitcoin strengthened dramatically in November 2025. When NVIDIA’s accounting issues force restatements and the stock declines toward fair value estimates of $68 to $82 per share, AI company valuations will face corresponding markdowns. These markdowns trigger margin calls on loans collateralized by Bitcoin. Liquidation cascades follow.

Response:

We are not aware of any accounting issues, restatements, or connections between cryptocurrency prices and the AI sector.

Hyperscale data centers may be threatened by decentralized alternatives

Claim:

Power shortages and the collapse of circular financing will redistribute capital allocation away from centralized hyperscale data centers toward decentralized alternatives like gaming computers, cryptocurrency mining facilities, and small data center operators.

Response:

AI is a full-stack, data center-scale endeavor encompassing chips, networking, systems, software, libraries, and services. Hyperscale cloud providers lead GPU deployments because they have the requisite capital and expertise to operate large data centers that produce AI at the highest levels of performance and utilization. Large, networked GPU deployments consume less power per token than GPUs at the edge. While we are optimistic about the proliferation of GPUs in PCs, edge devices, and small data centers, we view these markets as additive, not disruptive, to the hyperscale data center segment.

NVIDIA may be threatened by SEC enforcement action

Claim:

The Securities and Exchange Commission has not yet announced a formal investigation into NVIDIA’s accounting practices. However, several indicators suggest regulatory scrutiny has begun.

Response:

We are not aware of any SEC investigations. NVIDIA complies with the law in all respects and cooperates with all relevant government agencies.